💸 Lost money in crypto last year? You can save thousands on your taxes.

Learn more🔍 SURVEY: Most investors don’t know that crypto losses can lead to massive tax savings!

Learn moreThe platform designed to make filing your crypto taxes and tracking your gains & losses easier than ever.

Get Started For Free

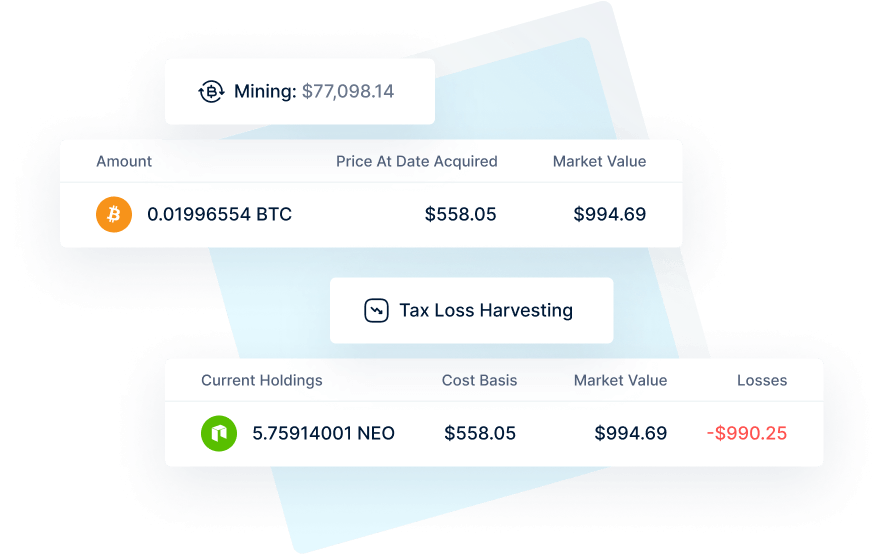

Find your biggest tax-saving opportunities across your portfolio.

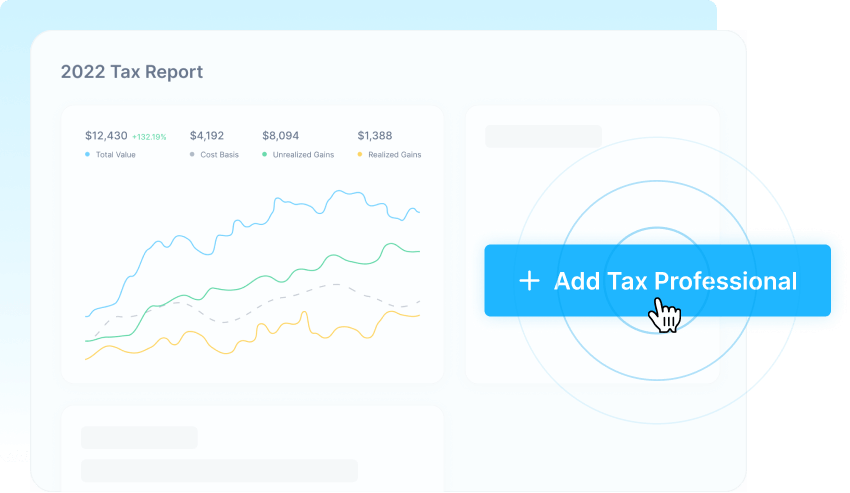

Upload your tax report to platforms like TurboTax, TaxAct, H&R Block, TaxSlayer, and many more!

CoinLedger’s support team is available to all customers via email and support chat.

Here’s how CoinLedger can simplify your tax season.