Streamline your clients' crypto tax reporting

- Unified Client Dashboard

- Form 8949 & Income Reports

- Complete Audit Trail

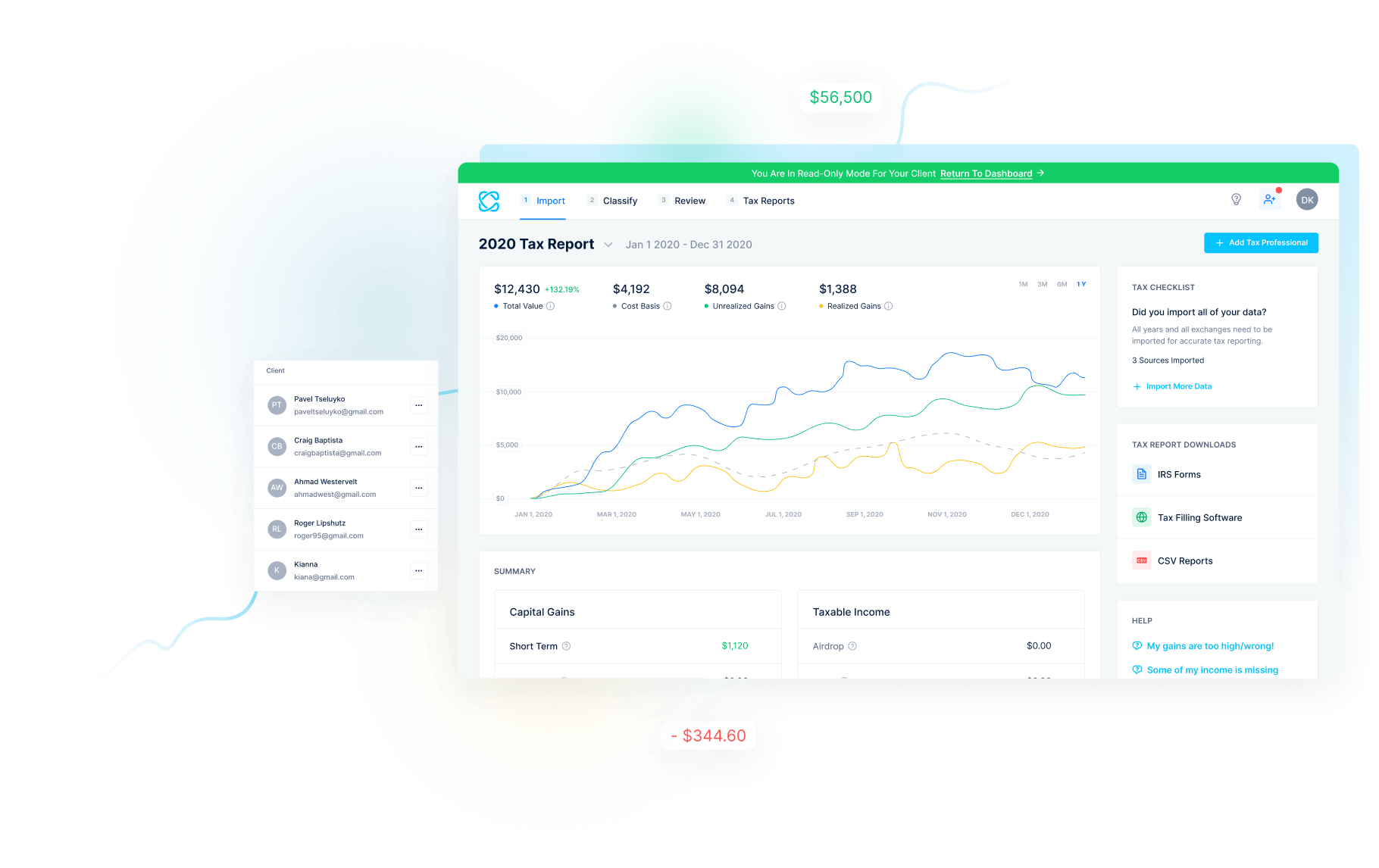

CoinLedger guides your clients through a step-by-step process for importing their cryptocurrency transactions. Once complete, their tax forms will auto-populate on your tax professional dashboard for easy viewing, downloading, and filing.

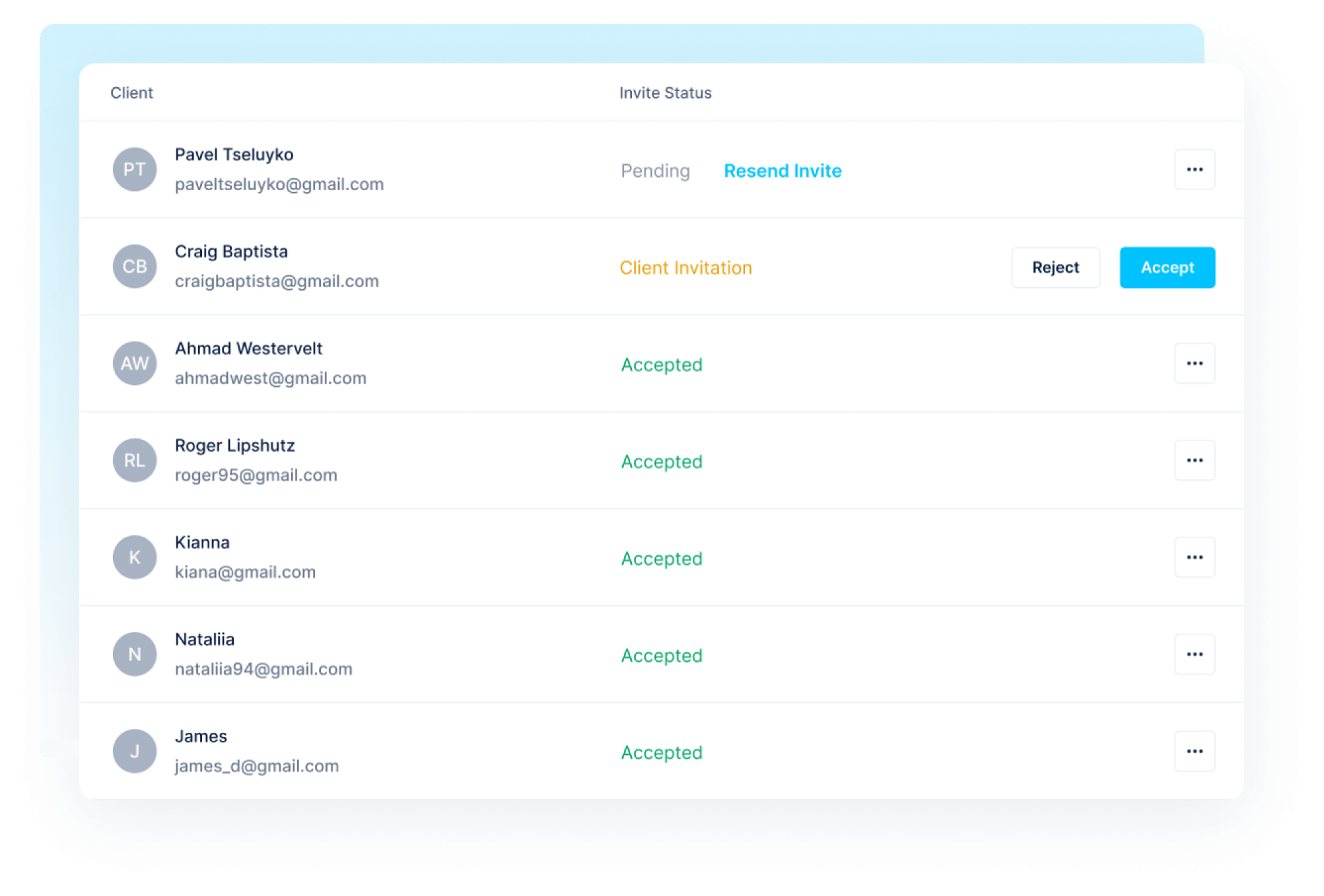

Start by inviting your clients to create an account and import their cryptocurrency data.

Directly access your client's account and review their crypto transactions. Coin Ledger flags any transactions with missing cost basis to help you reconcile missing data.

Once your client has imported their trades and generated their tax report, you can download their completed tax forms with the click of a button.

Your client's tax reports will be auto-generated using the transaction data imported into CoinLedger. You receive full access to the following reports that you can file yourself or import into your preferred tax filing software such as ProConnect, Drake, ATX, UltraTax, and more.

View The ReportsInvite as many clients as you need under your tax professional account. Your client dashboard gives you a convenient way to access each account, help reconcile missing transactions, and keep all client data protected in a single location.

Create a Free Account

No more back and forth over email with sensitive information. CoinLedger guides your client through the process of securely importing all of their cryptocurrency transactions without your assistance. Once the data is in, you can download and view their entire tax report.

See How It WorksOur complete Crypto Taxes 101 guide covers everything you and your tax practice needs to know. From the basics of cryptocurrency, all the way to preparing necessary tax reports for your clients, this guide will help you master cryptocurrency taxation.

Download For Free

This guide breaks down everything you need to know about cryptocurrency taxes, from the high level tax implications to the actual crypto tax forms you need to fill out.